Rebates

|

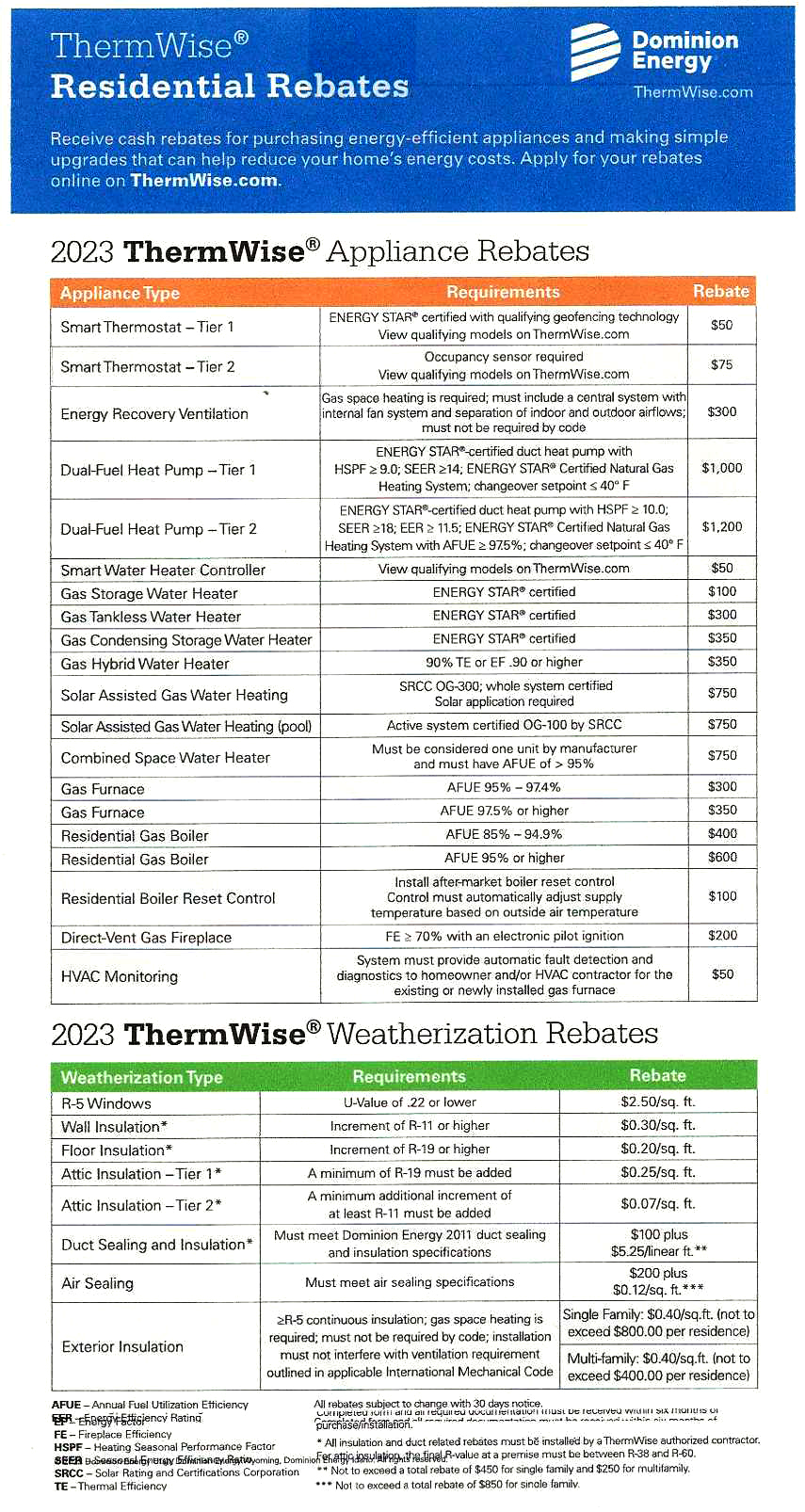

1384 North Angel Street Want to put some extra cash in your pocket as well as save money on your monthly utility bills? Upgrade your heating & air conditioning units to energy star efficient models & take advantage of the following rebates & incentives that are available to you. Thermwise (Dominion Energy) |

|

|

|

|

Wattsmart (Rocky Mountain Power)https://wattsmartsavings.net/washington-residential/find-savings-heating-and-cooling/

Federal Tax Credits:https://www.energystar.gov/about/federal_tax_credits/non_business_energy_property_tax_credits Contact your tax advisor for additional information. |

|